.webp)

Govt. introduces option of settling PAYE taxes through employers

COLOMBO (News1st): Sri Lanka's tax authority has called on employees liable for Pay As You Earn (PAYE) taxes to settle the payments for the months of January to March, before May 15, granting an option to pay them through their employer.

Employees who earn more than Rs 250,000 a month are liable for this tax according to the existing regulations.

The Inland Revenue Department (IRD) in a circular issued this week said the employer can make PAYE tax payments with the consent of the employee, considering the inconvenience faced by employees in making the payment.

Employers also have the option of settling the liability without making any deductions, the circular read.

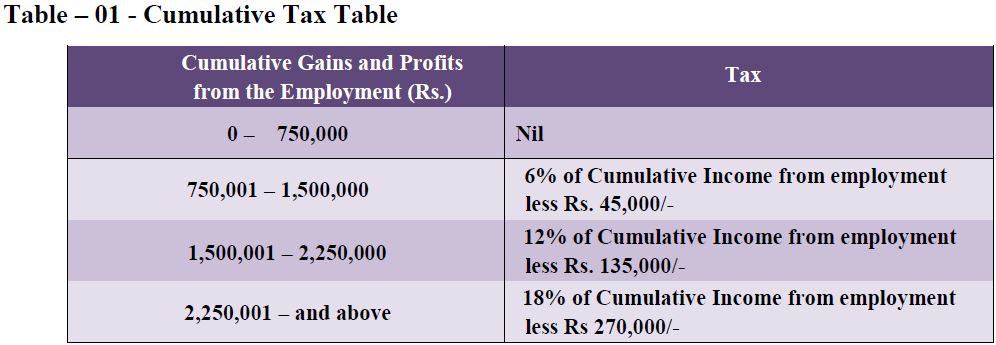

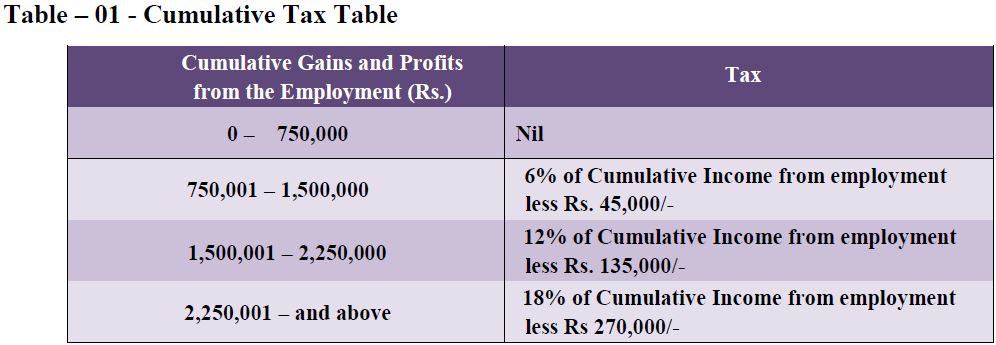

Accordingly, employees who agree to deduct the tax from their salaries, and have earned between Rs 750,000 to Rs 1.5 million in total from January to March will be liable to a six percent tax rate.

Similarly, a 12 percent rate for those who earned between Rs 1.5 million and Rs 2.25 million, and a rate of 18 percent for earnings of Rs 2.25 million and above, could also be imposed, the IRD said.

Meanwhile, a separate set of rates have been announced for employers who agree to settle the taxes without deducting an employee's salary.

Accordingly, the total tax payable should be calculated by adding up the tax decided based on the income of the employee, and also the Tax on Tax rates set out by the IRD.

A 6.38 percent rate for taxes up to Rs 42,300, a 13.64 percent rate for taxes ranging from Rs 42,301 to Rs 121,500, and a 21.95 percent rate for taxes starting from Rs 121,501 and above would be applicable, in this situation.

Meanwhile, a separate set of rates have been announced for employers who agree to settle the taxes without deducting an employee's salary.

Accordingly, the total tax payable should be calculated by adding up the tax decided based on the income of the employee, and also the Tax on Tax rates set out by the IRD.

A 6.38 percent rate for taxes up to Rs 42,300, a 13.64 percent rate for taxes ranging from Rs 42,301 to Rs 121,500, and a 21.95 percent rate for taxes starting from Rs 121,501 and above would be applicable, in this situation.

Last week, the IRD issued a circular stating that the new tax could be paid by employees earning more than Rs 250,000 monthly or Rs 3 million for a year.

Last week, the IRD issued a circular stating that the new tax could be paid by employees earning more than Rs 250,000 monthly or Rs 3 million for a year.

Meanwhile, a separate set of rates have been announced for employers who agree to settle the taxes without deducting an employee's salary.

Accordingly, the total tax payable should be calculated by adding up the tax decided based on the income of the employee, and also the Tax on Tax rates set out by the IRD.

A 6.38 percent rate for taxes up to Rs 42,300, a 13.64 percent rate for taxes ranging from Rs 42,301 to Rs 121,500, and a 21.95 percent rate for taxes starting from Rs 121,501 and above would be applicable, in this situation.

Meanwhile, a separate set of rates have been announced for employers who agree to settle the taxes without deducting an employee's salary.

Accordingly, the total tax payable should be calculated by adding up the tax decided based on the income of the employee, and also the Tax on Tax rates set out by the IRD.

A 6.38 percent rate for taxes up to Rs 42,300, a 13.64 percent rate for taxes ranging from Rs 42,301 to Rs 121,500, and a 21.95 percent rate for taxes starting from Rs 121,501 and above would be applicable, in this situation.

Last week, the IRD issued a circular stating that the new tax could be paid by employees earning more than Rs 250,000 monthly or Rs 3 million for a year.

Last week, the IRD issued a circular stating that the new tax could be paid by employees earning more than Rs 250,000 monthly or Rs 3 million for a year.Other Articles

Featured News

.png )

-826005_550x300.jpg)

-825999_550x300.jpg)

-825987_550x300.jpg)

-825981_550x300.jpg)

-825975_550x300.jpg)

-822734_550x300.jpg)

-822716_550x300.jpg)

-822495_550x300.jpg)

.gif)