.webp)

CBSL to implement flexible inflation targeting

Colombo (News1st) - The Central Bank says it is working towards implementing a flexible inflation targeting framework from next year.

Under a flexible inflation targeting regime, the central bank will announce the inflation target for a period of time and raise or lower interest rates accordingly. The strategy is expected to maintain price stability and thereby propel economic growth.

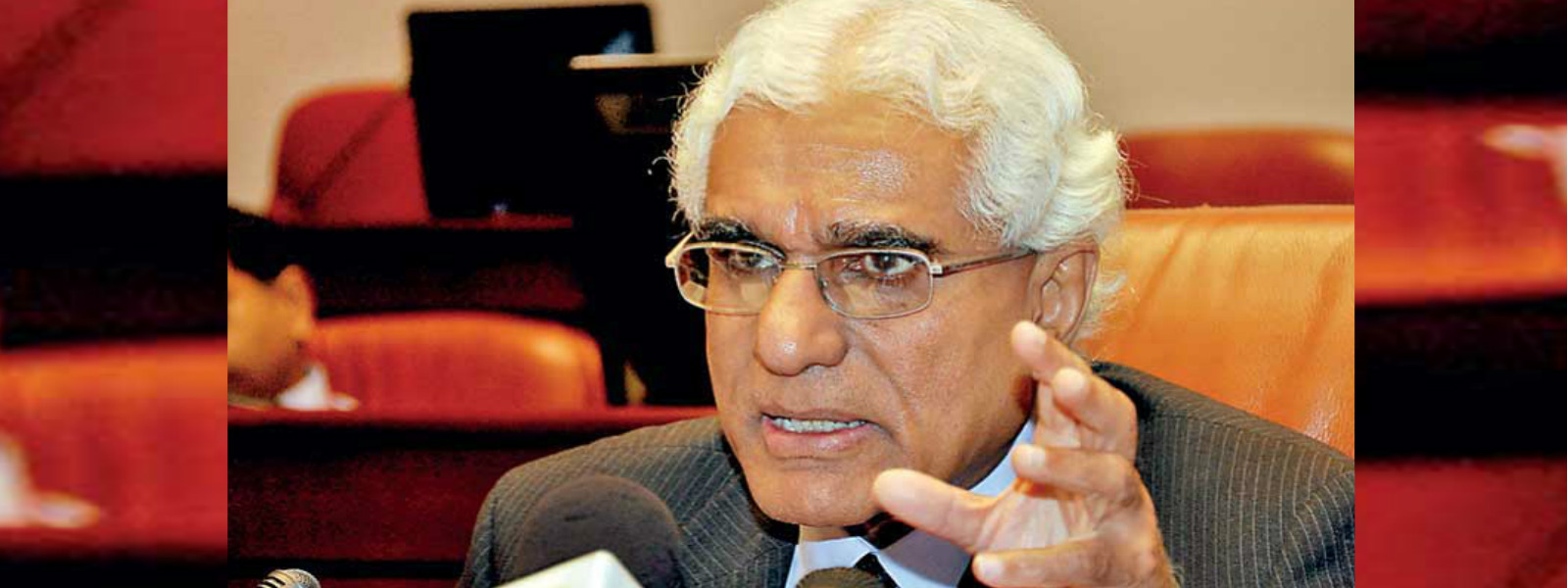

Governor of the Central Bank of Sri Lanka Dr. Indrajit Coomaraswamy said arguably the flagship initiative is the introduction of the flexible inflation targeting regime and the amendment of the monetary law act, to accommodate such a monetary policy formulation regime. He added that they have made very satisfactory progress, therefore they feel they are on track to have a fully-fledged flexible inflation regime by the end of the first quarter of next year.

The Governor added that they had received cabinet approval for the broad framework of the program and that they are optimistic that they will be able to complete this work on time. Governor Coomaraswamy stated this would be a landmark achievement which will enable them to have a much more forward-looking proactive monetary policy which is focused on anchoring expectations.

It is generally believed that raising interest rates results in lower inflation and lowering interest rates usually accelerates the economy, thereby boosting inflation. Sri Lanka has experienced high inflation due to excessive money printing by the Central Bank aimed at keeping interest rates low and financing the budget deficit. Experts say a flexible inflation targeting regime will create greater transparency and accountability of monetary authorities.

Other Articles

Featured News

.png )

-797954_550x300.png)

-797273_550x300.jpg)

.gif)