.webp)

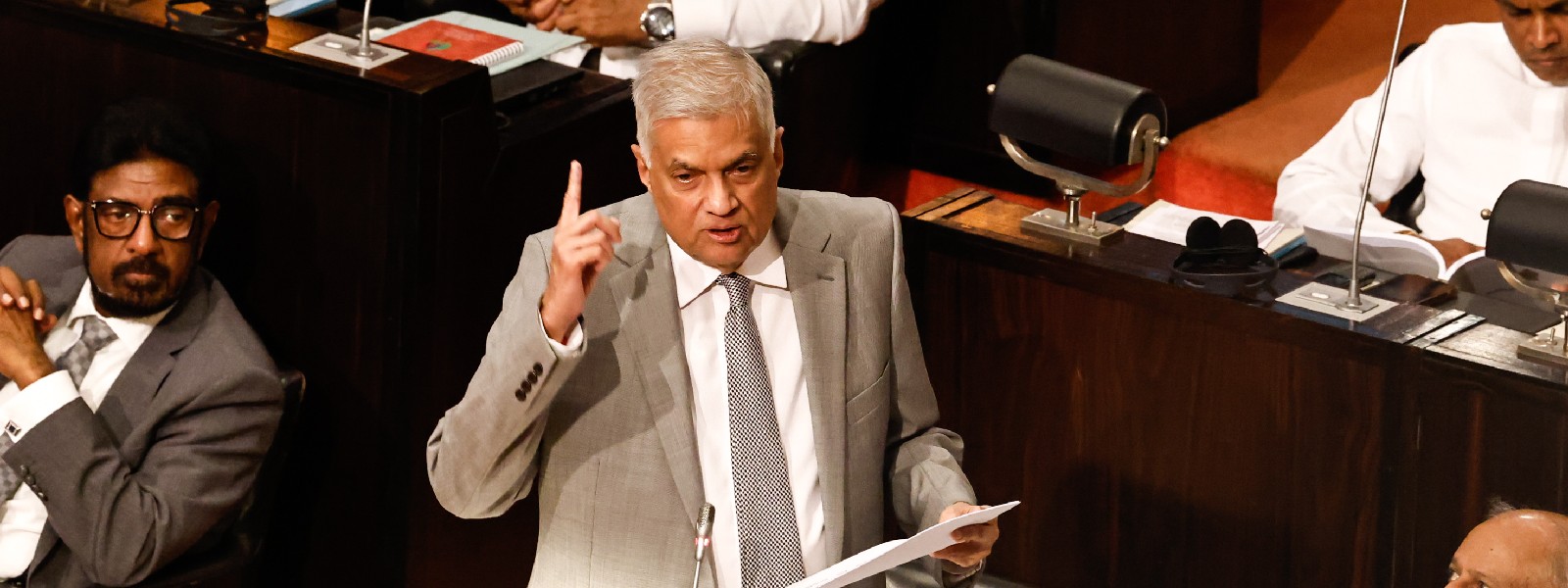

Reforms NOT limited to IMF - President

COLOMBO (News 1st) - Sri Lankan President Ranil Wickremesinghe on Monday (14) told Parliament that the economic reforms introduced are not limited to those agreed upon with the International Monetary Fund.

"These proposed reforms by the International Monetary Fund are limited only to economic stabilization," he said.

The President also said that "Our envisaged reforms and reorganizations are what the country has needed for a long time to build a new economy. This is a role that many governments have opted to ignore with popularity in mind. We will undertake onerous duty for the country."

Macro-fiscal Framework as per the Budget document:

a) Our fiscal stabilisation programme envisages government revenue increasing to around 15 percent of GDP by 2025 from the 8.3 percent of GDP as at end 2021.

b) The government is targeting a primary surplus of more than 2 percent of GDP in 2025 and expects to improve upon this level thereafter.

c) We aim to reduce public sector debt from around 110 percent of GDP as at end 2021, to no more than 100 percent of GDP in the medium term.

d) It is expected that inflation will be brought back under control to a mid-single digit level in the medium term.

e) In line with this, interest rates are also expected to gradually reach a moderate level.

f) Once macroeconomic confidence is re-established and foreign exchange reserves are replenished through foreign finances, the adverse pressure on the exchange rate is also expected to abate.

g) With the implementation of a series of growth enhancing structural reforms, the medium-term economic growth is expected to return towards 5 percent in the medium term and accelerate to a higher level thereafter.

Reforms:

Public Service Reforms:

There are around one million four hundred and fifty thousand (1,450,000) public servants currently working in various government agencies. Hence, a large portion of government revenue is spent on their salaries. Therefore, it has become a challenge to allocate resources for other public purposes, including developmental purposes. Therefore, I propose to appoint a Presidential Commission to review all aspects of public service in line with current requirements and make recommendations including necessary reforms.

Presidential Commission on Taxation:

It has been difficult to allocate resources to health, education and other important sectors due to the low level of government revenue generated from taxes in comparison to other countries. Accordingly, measures should be taken to gradually increase state revenue in the next few years. As such, I propose to establish a Presidential Commission on Taxation to study and make recommendations on the functioning, coordination and changes to be made in the tax structure, the institutions, procedures etc. This Commission will also examine the requirement for setting up of a centralized institution for managing government revenue.

Promotion of Electronic Payment System:

I propose to make it mandatory for all government payments to be made electronically (online) with effect from 01.03.2024 including cash grants to the respective recipients as well as the payments for obtaining services from various government agencies by the public. Accordingly, all government agencies should also take action to prepare a program enabling online payments for those services and introduce the necessary legal changes as well. In this regard, required assistance should be sought from the IT Service Officers currently working in ministries and departments. I propose to allocate Rs.200 million for the implementation of this policy.

Setting up of Data Protection Authority:

As we develop our digital economy, there is a need to regulate the processing of personal data in order to safeguard the privacy of our citizens from adverse impact of digitization. The government is committed to implement the Personal Data Protection Act, No. 9 of 2022 and will take steps to set up the Data Protection Authority in 2023. The new regulator will be independent and engaged with the Central Bank of Sri Lanka, Securities and Exchange Commission, TRCSL and all relevant sectoral regulators to ensure a proper governance of personal data.

Insurance coverage for Private Sector Employees:

It is noted that the number of private sector employees who lose their jobs due to various reasons is on the increase. As this has become a very complex social issue with the current economic crisis, I propose to an insurance coverage to provide a monthly allowance for a maximum of three months covering the period from the loss of employment and re-employment and to establish an insurance fund for this purpose.

Further, a large number of people are benefitted from the Agrahara health insurance system provided for government employees and I propose to provide similar health insurance to private sector employees as well.

A contribution is provided to the Employees’ Trust Fund by the employers on behalf of private sector employees. Therefore, it will be a duty and responsibility to provide some relief from the Employees Provident Fund. Accordingly, Accordingly, it would be appropriate to allocate a certain amount from the Employees’ Trust Fund for the proposed health and insurance coverage.

Accordingly, Employees’ Trust Fund Act should be amended incorporating these two schemes under the Employees’ Trust Fund.

Other Articles

Featured News

.png )

-790741_550x300.jpg)

-790735_550x300.jpg)

-790717_550x300.jpg)

-788774-790711_550x300.jpg)

-789996_550x300.jpg)

-789879_550x300.jpg)

-789357_550x300.jpg)

-788581_550x300.jpg)

.gif)