.webp)

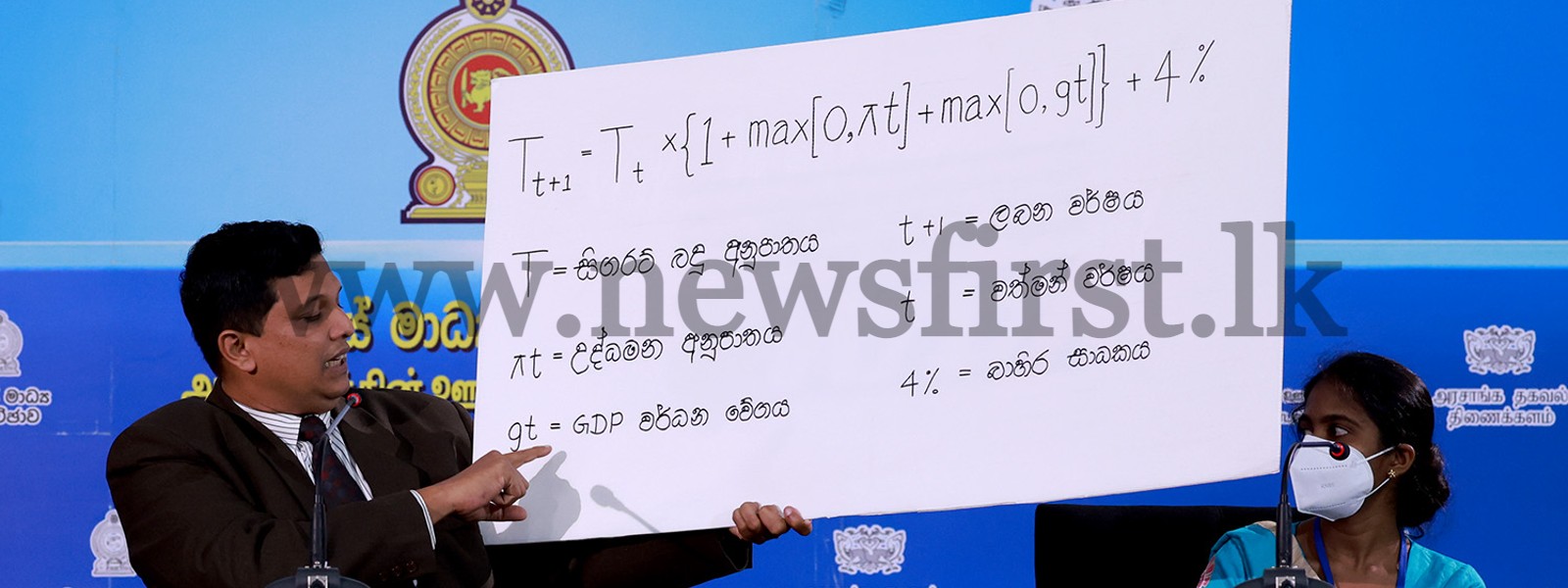

Tax Formula to determine cigarette price - NATA

COLOMBO (News 1st); Sri Lanka's National Authority on Tobacco & Alcohol (NATA) is hoping to introduce a tax formula to determine the price of a cigarette in Sri Lanka.

Dr. Samadhi Rajapaksa, the Chairman of NATA said on Thursday (30) that if the tax formula is implemented the state revenue will increase rapidly, with a 6% increase per annum.

He also noted that the tax formula will also make it difficult to purchase cigarettes as well.

"When that happens, Sri Lanka will be able to reduce the number of people who smoke," he told a briefing at the Department of Government Information.

He said the respective tax formula will be presented to the Cabinet and the formula consists of 6 separate components, namely, the Cigarette Tax Percentage, Proposed Price for next years, Inflation Percentage, Present Price, GDP, and the external factor of 4%.

He said the 4% external factor is added to ensure that the price of a cigarette is increased every year, even if inflation drops to zero.

The NATA Chairman said when this formula is implemented there can be NO influence by any entity to determine the price of a cigarette.

He said that the formula was prepared by local and international experts and when it is applied it will become a national policy to determine the price of a cigarette.

Other Articles

Featured News

.png )

-722285-796450_850x460-796572_850x460-796750_550x300.jpg)

-796744_550x300.jpg)

-796738_550x300.jpg)

-794314_550x300.jpg)

.gif)