.webp)

Rs. 50 Fuel Tax Tied to Massive Debt Repayment, Says Minister

COLOMBO (News 1st); The government has clarified that a significant portion of the taxes collected from fuel sales is being used to repay a massive Rs. 884 billion debt inherited from the previous administration.

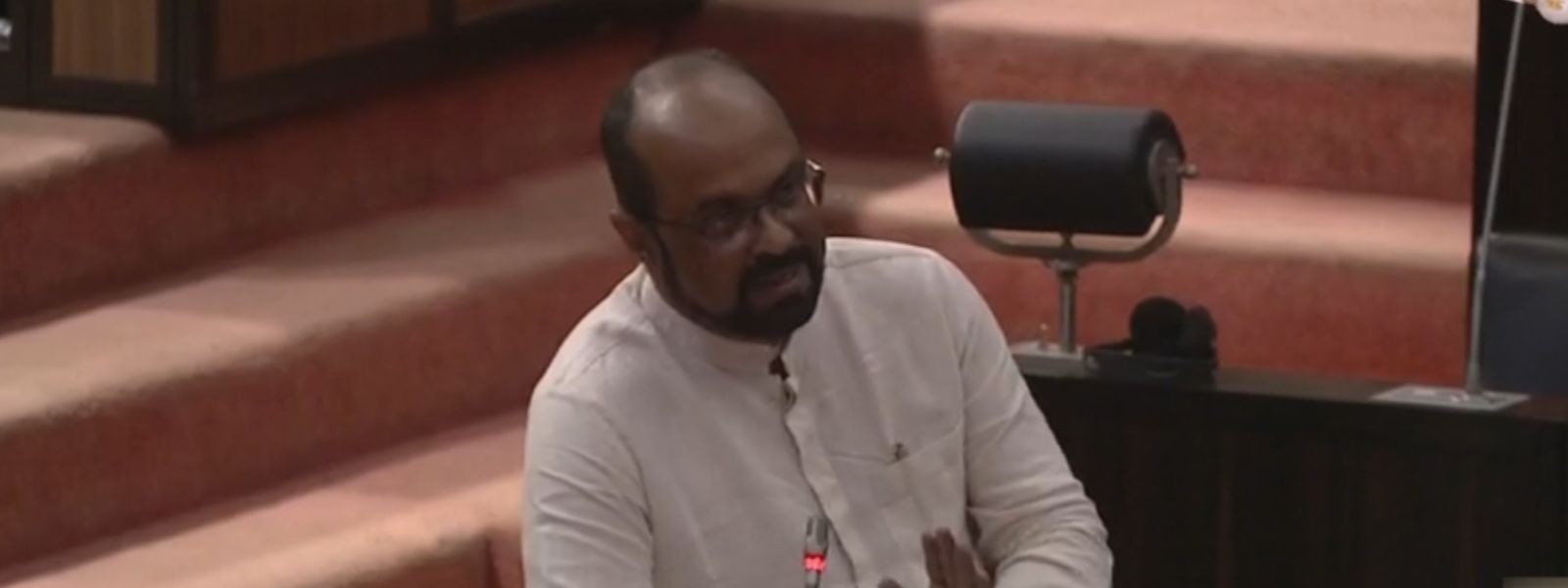

This was revealed in Parliament by Minister of Power and Energy Kumara Jayakody, in response to allegations raised by Samagi Jana Balawegaya MP Dayasiri Jayasekara regarding the misuse of fuel revenue.

Minister Jayakody explained that a Rs. 50 tax per litre was specifically introduced to service this debt, and that nearly half of it has already been repaid through the Treasury. He assured that once the full amount is settled, the government would consider removing the additional tax burden. Other taxes, he noted, are standard levies required for government revenue.

Jayasekara, however, questioned the transparency of the current fuel pricing mechanism. He pointed out that since April, the pricing formula has not been made public, leaving citizens in the dark about key cost components such as import prices, unloading fees, processing costs, storage charges, and taxation.

Citing figures from June, Jayasekara claimed that the landed cost of a litre of 92 Octane petrol was Rs. 161.18, while Rs. 120.42 was collected as tax. He alleged that such high margins were previously accused of being diverted into the personal accounts of a former minister, and demanded clarity on whether such practices had truly ended.

In response, Minister Jayakody distinguished between two financial components: premiums and taxes. He stated that while premiums—previously as high as USD 35–37 per metric ton—have now dropped to around USD 3–5, taxes are directed to the state and not to individuals. He emphasized that premium rates vary by tender and supplier, and that it is inaccurate to assume a fixed rate or misuse without evidence.

Other Articles

Featured News

.png )

-799309_550x300.jpg)

-797273_550x300.jpg)

.gif)