.webp)

All licensed banks must provide uninterrupted banking services - CBSL

COLOMBO (News 1st); The Central Bank of Sri Lanka (CBSL), upon obtaining approval/consent of the Director-General of Health Services and the Inspector General of Police (IGP), has requested licensed commercial banks and licensed specialized banks (licensed banks) to carry out essential banking services, strictly adhering to all relevant safety measures and guidelines issued in providing banking services under the on-going travel restrictions to control the spread of COVID-19.

Accordingly, all licensed banks shall make necessary arrangements to provide uninterrupted banking services during the COVID-19 outbreak complying with the following:

⦁Opening of bank branches only to provide essential services such as trade financing, treasury operations, clearing activities, payment of pensions/salaries, responding to other urgent requests/inquiries of customers, etc.;

⦁The number of staff permitted to report to work in branches of licensed banks shall not exceed 15 per branch;

⦁Staff shall report to work on a roster basis, or the branches shall only be opened on specified days taking note of specific requirements of customers of each branch; and

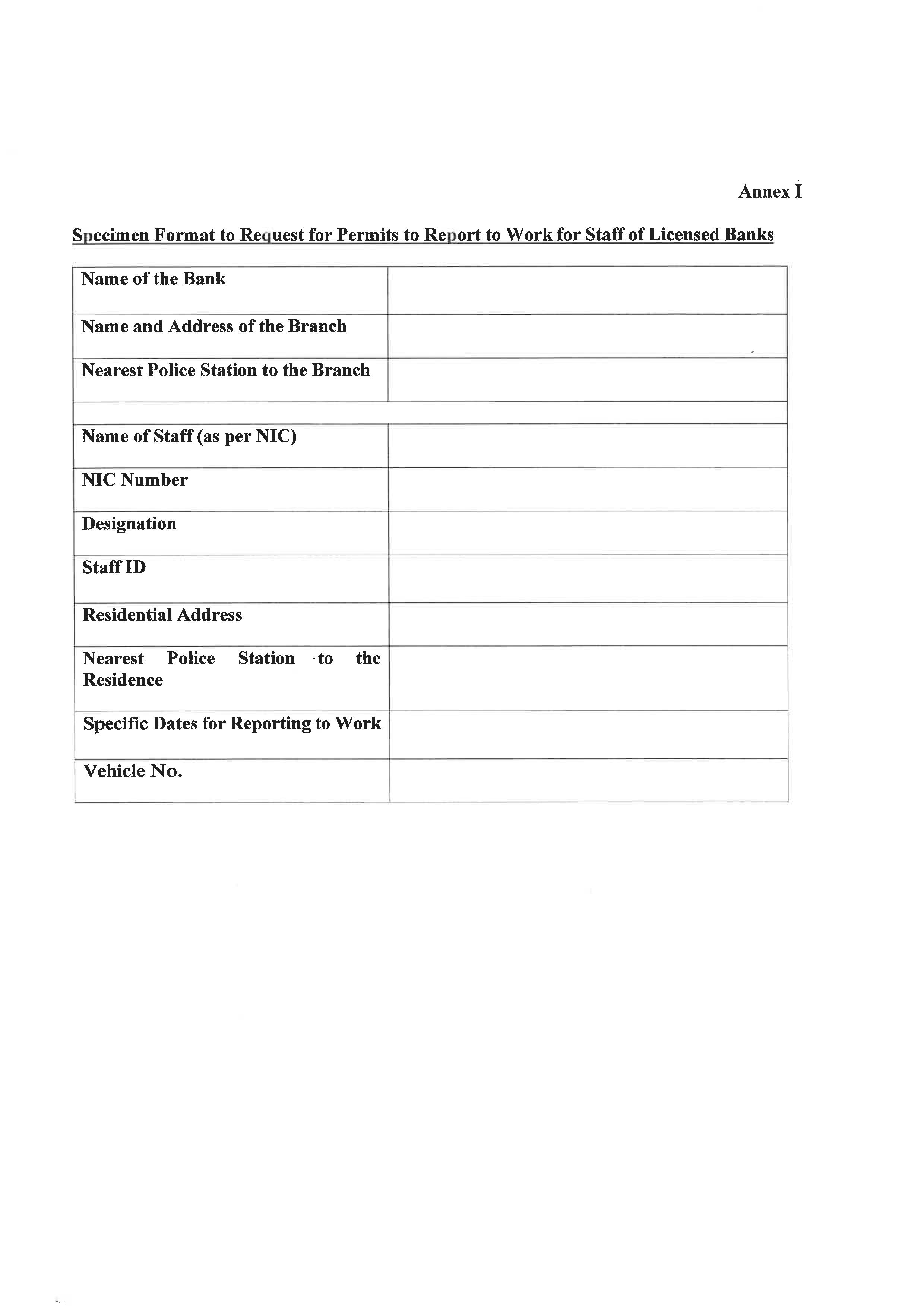

⦁Branch Managers shall obtain prior approval of the nearest Police Station for the travel of the relevant staff by producing a request letter containing relevant information including those provided in the specimen Annexed.

Licensed banks shall:

⦁Publish notices informing the general public how essential banking services can be obtained;

⦁Take adequate measures to keep the banks’ customers informed of the contact details for obtaining essential banking services during this period, including the display of contact details of branch staff at the branch and Hot-line numbers, considering the various preferred modes of transacting;

⦁Ensure that the customer inquiries are answered and resolved expeditiously; and

⦁Continue to facilitate the use of electronic/digital channels, including Automated Teller Machines (ATMs), Cash Deposit Machines (CDMs), Cash Recycling Machines (CRMs), and mobile banking vehicles.

Other Articles

Featured News

.png )

-810965_850x460-820142_550x300.jpg)

-819380_550x300.jpg)

-812087_550x300.jpg)

-810262_550x300.jpg)

.gif)